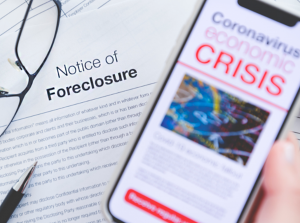

As Foreclosure Relief Ends, California’s SB-1079 Back In The Spotlight

California’s recently enacted foreclosure reform laws promulgated under SB-1079 (the “Bill”) received much attention when it went into effect at the beginning of the year amid economic uncertainty stemming from the COVID-19 pandemic with many bracing for the possibility of future widespread foreclosures once moratoriums lifted and other pandemic forbearance protection programs ended. Given the federal moratorium on foreclosures recently ended on July 31, 2021 and many pandemic forbearance plans will remain in effect only until the end of September, it remains to be seen how significant foreclosure activity will increase due to the pandemic.

Codified in Civil Code section 2924m(c)(2), the Bill modifies the non-judicial foreclosure auction bidding process by most notably affording what is essentially a right of first refusal to tenants, prospective owner-occupants, and community non-profits (such as housing trusts), among other statutorily defined “eligible bidders”, allowing them to purchase a one to four unit single-family residence after foreclosure by either matching or beating the winning bid. Eligible bidders are given a total of 45 days after the foreclosure sale by which to provide the trustee a bid before the sale will be deemed final so long as the trustee received a notice of intent to bid within the first 15 days following the foreclosure sale. Post foreclosure sale (provided the winning bid was not made by a prospective owner-occupant), eligible tenant bidders only need to bid an amount equal to the last and highest bid at the foreclosure sale, while in the case of all other types of “eligible bidders”, the bid only needs to exceed the last and highest bid. The Bill also prohibits the bundling of properties for sale to a single buyer through foreclosure (unless the deed of trust requires otherwise), creates new foreclosure procedural requirements, and increases civil fines imposed against owners that fail to maintain properties purchased at foreclosure.

The Bill was a response to California’s affordability crisis and issues seen during the many foreclosures that occurred during 2007-2010 when California experienced significant declines in owner-occupied housing, cited in large part to be a result of the entry of institutional investors in the rental market. The first test of the Bill since enactment made headlines at the end of April, 2021 when a bay area tenant beat the winning foreclosure bid by partnering with a community land trust. Partnership with a land trust involves entering into an agreement with the trust with an agreement to sell the property to the next owner at an affordable price subject to the land trust agreement. Though not yet clear what impact the Bill will have on California’s affordability crisis, if this first test is any indication, it may well lead to more property ownership being subject to similar covenants if community land trust partnerships are widely utilized to take advantage of the new post foreclosure bidding process.

It is important for lenders bidding on their own collateral in foreclosure to not only have an understanding of the new obligations and procedures implemented by the Bill (which includes, among other things, the requirement that foreclosing lenders send foreclosure language to all current tenants outlining their right under a trustee’s sale), but also an understanding of how the new rules will affect their bidding strategy at foreclosure. Up to this point, a lender’s bidding strategy at a foreclosure auction of its own collateral already posed the need for a careful calculation to determine the bid amount, while, of course, staying far away from the dreaded full credit bid. Now that winning bids may be beaten post-foreclosure, Lenders will need to reevaluate their strategy and be even more careful when determining their bid at auction.

By Geoffrey M. Olin

Associate at Frandzel Robins Bloom & Csato, L.C.